Are you in the market for a new Air Conditioning System for your home? Good News, with the help of federal energy tax credit programs, you can Save Green by Going Green with the purchase of eligible Heil® equipment. Have you heard of the Inflation Reduction Act of 2022? Signed in August 2022, it promises to reduce inflation, tackle the climate crisis, lower energy costs for households and businesses, and create manufacturing jobs for American workers. Good news for homeowners, you can save up to $300 with the Inflation Reduction Act of 2022 including several tax credits for the installation of Heil® ENERGY STAR®certified home heating and cooling systems.

Take Advantage of Current Energy Tax Credits on a New Heil Home Comfort System.

How Does the Inflation Reduction Act Work?

Essentially, the Inflation Reduction Act offers IRS Section 25C tax credits for qualified energy efficiency improvements and/or the installation. Homeowners may be eligible for a credit against their taxes for an amount equal to:

-

Ten percent of the amount paid or incurred during the taxable year, up to $500 or a specific amount from $50 to $300, depending on the heating and cooling equipment installed.

-

The amount of the residential energy property expenditures paid or incurred during the taxable year.

-

The IRS Section 25C tax credit is retroactive to January 2018. Homeowners may choose to amend their taxes to take advantage of the tax credit.

Note: This article is intended only as a guide, but here’s a summary of the Inflation Reduction Act and how it could help homeowners save on Heil® heating and cooling products.

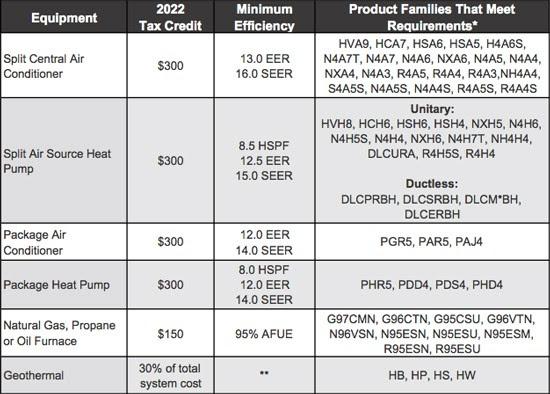

Which Heil® Products Qualify for These Tax Credits?

Several Heil® heating and cooling products may qualify for the IRS Section 25C tax credits under the Inflation Reduction Act, including high-efficiency ACs, heat pumps, SPPs, and gas/propane/oil furnaces. Energystar.gov has some great resources. Click here for more details.

*Qualification depends on the specific model and system combination installed. Consult the AHRI® Directory or www.ICPeqp.com/default.aspx for a list of applicable combinations.

Heil® Products That May Qualify for Tax Credits